Litecoin Halving: Definition, When It Happens, How It Works, and Why It Matters.

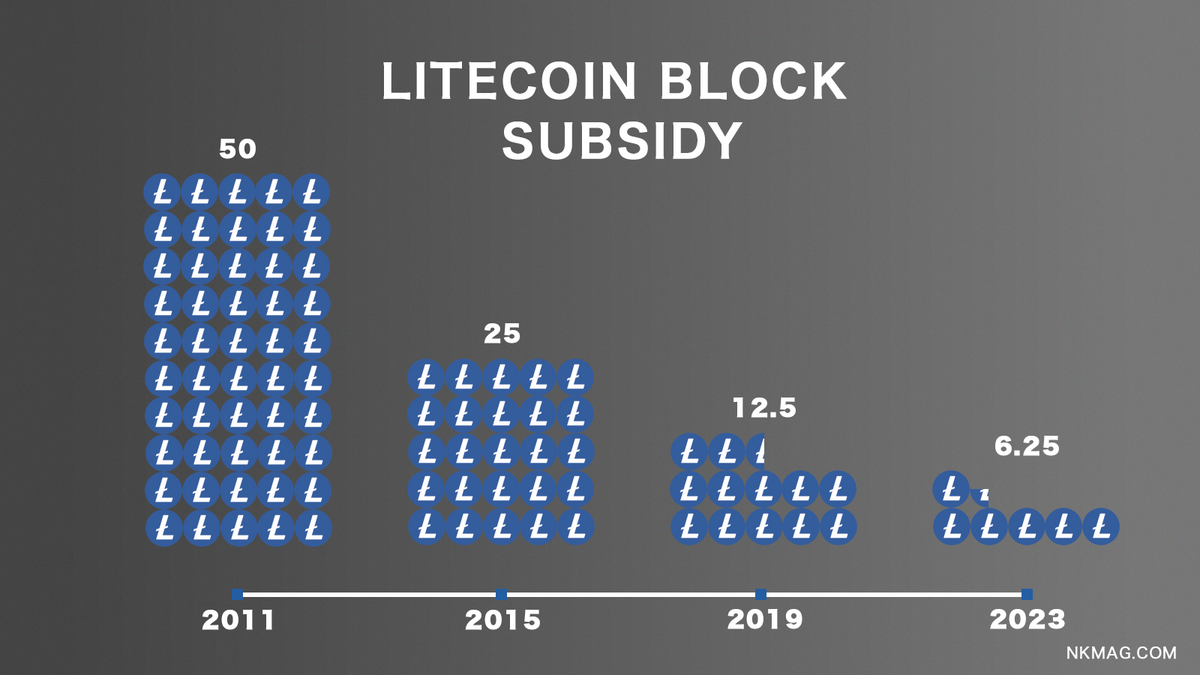

After every 840,000 blocks mined, or roughly every four years, the block subsidy given to Litecoin miners for processing and securing transactions is cut in half.

What is Litecoin Halving?

The Litecoin halving is an important event in the Litecoin monetary system that reduces the subsidy for each block mined by 50% every 840,000 blocks, roughly every four years. The Litecoin halving means Litecoin has a disinflationary monetary system with a current block subsidy of 12.5 halved to 6.25 Litecoin for every block mined. One Litecoin block is mined every 2.5 minutes. This reduction in the block subsidy means that there will be fewer Litecoin subsidized per block and introduced into the market, which can lead to an increase in the price of Litecoin, assuming the demand stays the same.

When Did the Litecoin Halvings Happen?

The first Litecoin halving happened on August 25, 2015, at a block height of 840,000. The block subsidy was reduced from 50 coins to 25 coins per block.

The second Litecoin halving happened on August 5, 2019, at a block height of 1,680,000. The block subsidy was reduced from 25 coins to 12.5 coins per block.

Upcoming Halving

The third Litecoin halving is expected to happen in August 2023 at a block height of 2,520,000. The block subsidy will be reduced from 12.5 coins to 6.25 per block.

The fourth Litecoin halving is expected to happen approximately July 2027 at a block height of 3,360,000. The block subsidy will be reduced from 6.25 coins to 3.125 per block.

And so on.

What Effects Does The Litecoin Halving Have?

The Litecoin halving is an important event that occurs every 840,000 blocks, roughly every four years. During the halving, the miners' block subsidy for adding new blocks to the Litecoin blockchain is reduced by 50%.

Here are some of the effects that Litecoin halving can have:

- Increase in the price of Litecoin: When the Litecoin subsidy per block is reduced by 50% while the demand for Litecoin remains constant, this could lead to an increase in the price of Litecoin.

- Decrease in mining profitability: The reduction in the block subsidy means that miners will receive fewer Litecoin for their efforts. This can lead to a reduction in mining profitability if the price does not increase, which may cause some miners to leave the network.

What Is Scrypt Mining?

Scrypt mining is a process used to secure and verify transactions on a cryptocurrency network and mint new coins as a subsidy. It is based on the Scrypt Proof-of-Work (PoW) algorithm. Scrypt is designed to be more memory-intensive and computationally demanding than other PoW hashing algorithms, such as SHA-256. Mining is a decentralized process performed by a network of computers. Most miners use specialized, efficient computers known as ASICs.

Here are the basics of Scrypt mining:

- Most miners use specialized hardware, known as ASICs (Application Specific Integrated Circuits), to solve complex mathematical problems, which helps verify and secure network transactions.

- When miners successfully add a block of transactions to the blockchain, they are subsidized with a certain number of coins. This subsidy is also known as the block subsidy or coinbase.

- The difficulty of the mathematical problems that miners need to solve is adjusted regularly to ensure that the rate at which new blocks are added to the blockchain remains steady. The difficulty adjustment of Bitcoin and Litecoin happens every 2016 blocks, which are about every 14 days for Bitcoin and 3.5 days for Litecoin.

- As more miners join the network and the competition for block subsidy increases, it becomes more difficult to mine a block successfully. Miners need to invest in more powerful and efficient hardware to remain competitive.

- Litecoin mining requires a lot of computational power and energy and can be costly. As a result, many miners choose to join mining pools, which allow them to pool hashing power and consistently split the block rewards.

What Happens When There Are No More Litecoin Left?

When the 84,000,000th Litecoin is mined in 2142, there will no longer be a block subsidy for miners to earn. In this case, miners will also need to rely on transaction fees to make a profit. These fees are paid by users who want to have their transactions processed by the network. Transaction fees will likely become more important as the block reward decreases. Still, it's difficult to predict precisely how this will play out, but the Scrypt Miners that mine Litecoin are merged mining Dogecoin with it.

What is Scrypt Merged Mining?

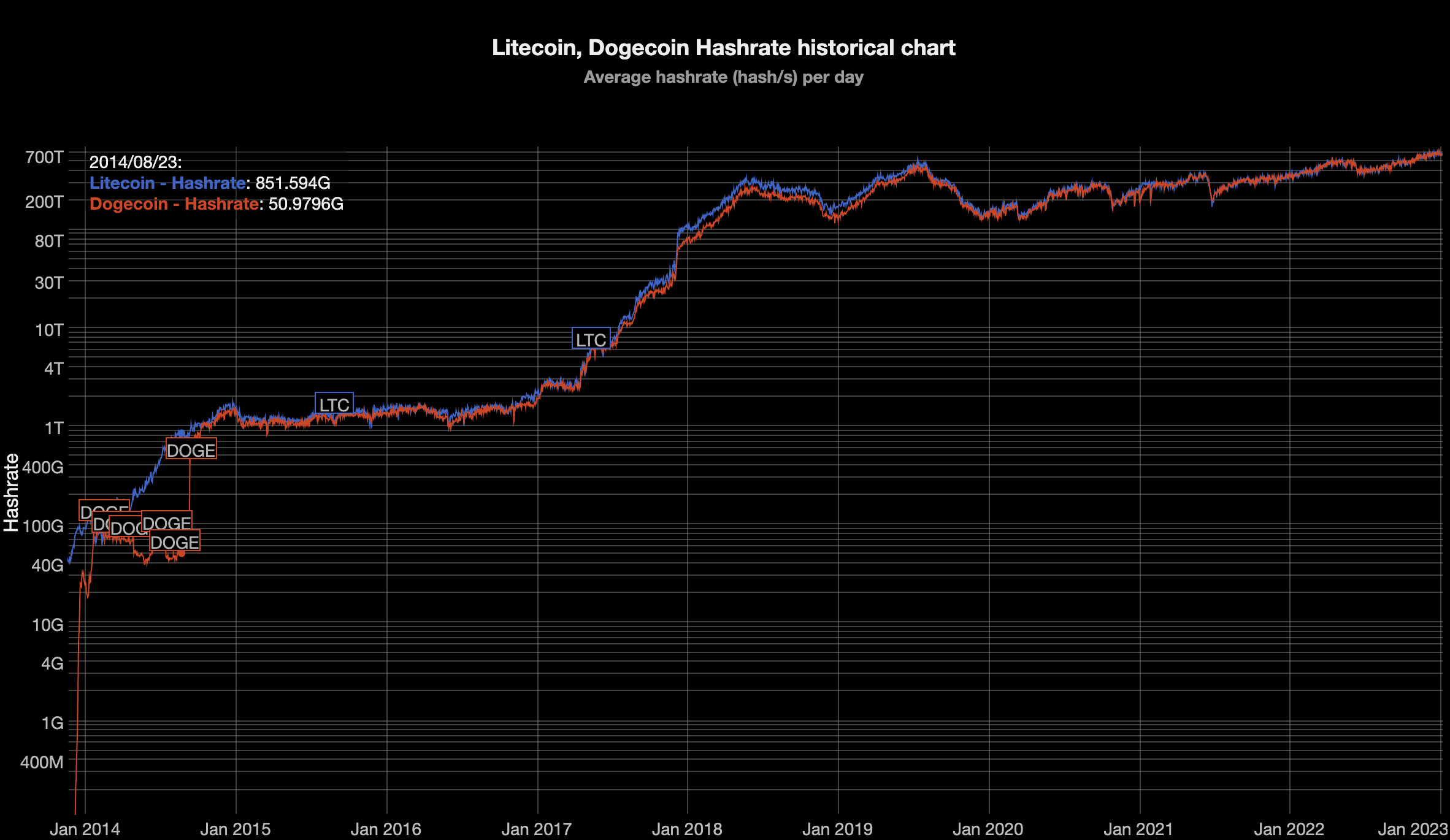

Merged mining, also known as Auxiliary Proof-of-Work (PoW), is a technique that allows a miner to mine for multiple cryptocurrencies simultaneously without having to perform additional work. It is the relationship between two blockchains for one to trust the other's work as their own and accept it. The miner can submit their proof-of-work to both networks, increasing the security of both networks and potentially earning additional subsidies for their mining efforts. SHA-256 Merged Miners mine Bitcoin and Namecoin as an AuxPoW. Scrypt Merged Miners mine Litecoin and Dogecoin as an AuxPoW.

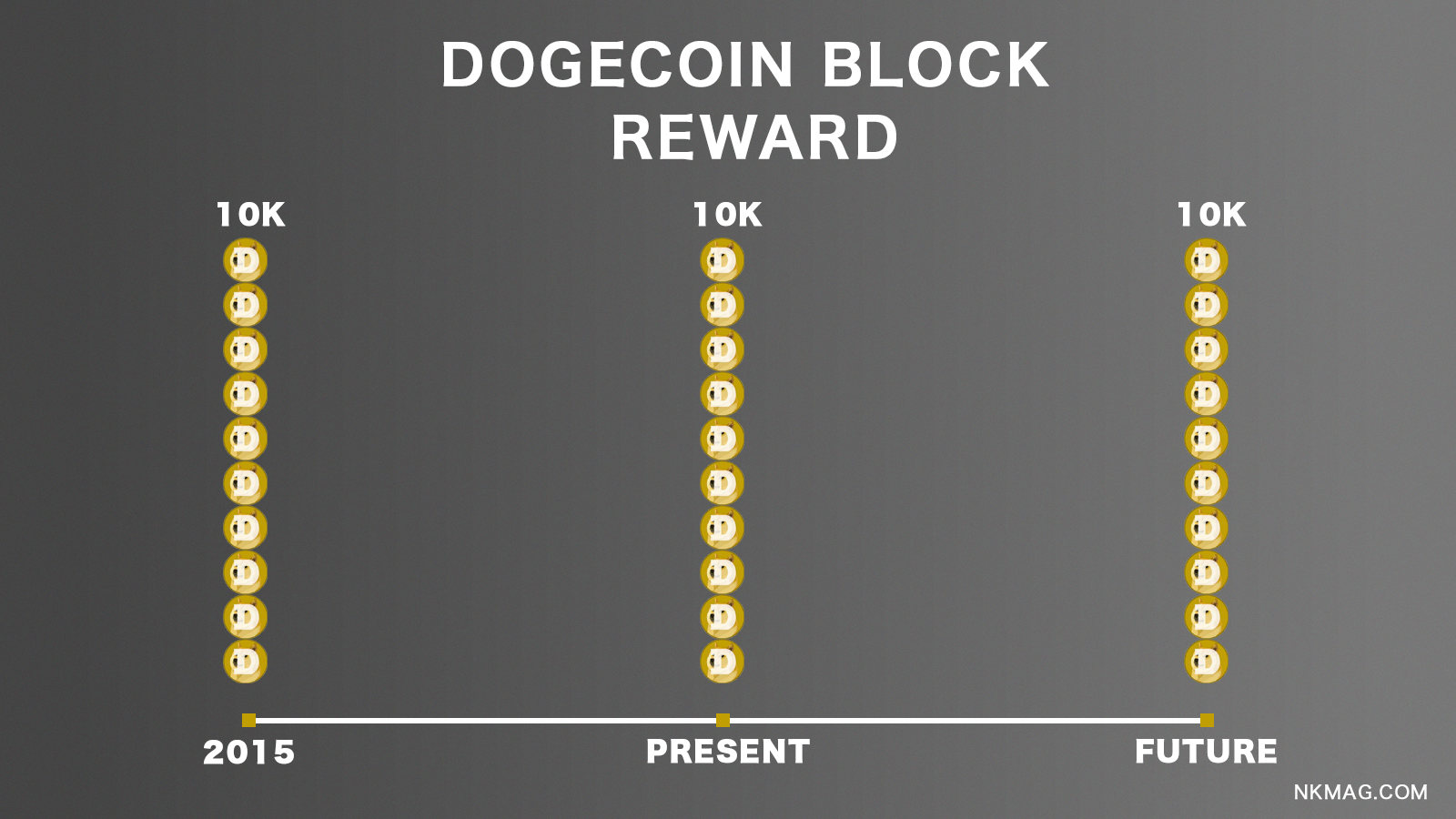

Dogecoin does not have a halving nor a fixed supply like Bitcoin and Litecoin. Dogecoin has a constant tail emission, which means that Dogecoin will create 10,000 new Dogecoin every block, with a block being mined approximately every minute. As the current circulating supply of Dogecoin grows, the rate of new coin inflation shrinks. This means that even after the last Litecoin has been mined, Scrypt miners will still be able to earn a subsidy for mining Dogecoin along with the transaction fees for Litecoin and Dogecoin, making it an attractive option for Scrypt Miners.

Impact of Halvings on SHA256 and Scrypt Miners: A Comparison

SHA256 and Scrypt miners will experience the halvings equally in terms of the reduced block subsidies from mining Bitcoin and Litecoin respectively. However, Scrypt miners also have the benefit of the constant tail emission from mining Dogecoin, which provides a steady stream of new coins and helps to offset the reduction in block subsidies from Litecoin. This means that Scrypt miners may have a slightly more stable revenue stream compared to SHA256 miners, who rely solely on block subsidies and transaction fees from mining Bitcoin.