The Fundamentals of Money

Money, from cowry shells to digital currencies like Bitcoin, embodies a universally accepted medium of exchange. Its properties—acceptability, divisibility, stable supply, portability, fungibility, and durability—define its effectiveness and utility.

Over 10,000 years ago, humans used cowry shells as an early form of money. Today, the concept of money extends far beyond tangible objects. Essentially, money is any entity that societies widely accept as payment for goods, services, or debt clearance. Its three primary roles are to serve as a medium of exchange, a unit of account, and a store of value.

Let's dive deeper into the characteristics that define money:

Acceptability

Money's power lies in its universal acceptability. It provides a common platform for the exchange of goods and services.

Divisibility

Money's usability improves with divisibility, allowing for flexibility in transactions and accommodating various price points. Imagine needing exact change for every purchase!

Limited Stable Supply

The stability of money's supply is crucial for maintaining economic equilibrium and preventing excessive inflation or deflation.

Portability

Money's ease of transportability makes it a convenient asset, aiding in wealth mobility and ensuring its accessibility during emergencies.

Fungibility

The interchangeability of money's individual units is an essential aspect, making any $10 bill as valuable as any other.

Durability

Money's resilience to long-term storage without depreciating in value is vital for retaining its worth. Imagine trying to save your wealth in perishable bananas!

As societies evolved, so did the forms of money:

Commodity Money

Essentially tangible goods like gold, silver, or bronze coins, this form of money possesses intrinsic value due to the worth of the commodity itself. These materials are typically durable, portable, divisible, and have relatively stable values, making them ideal.

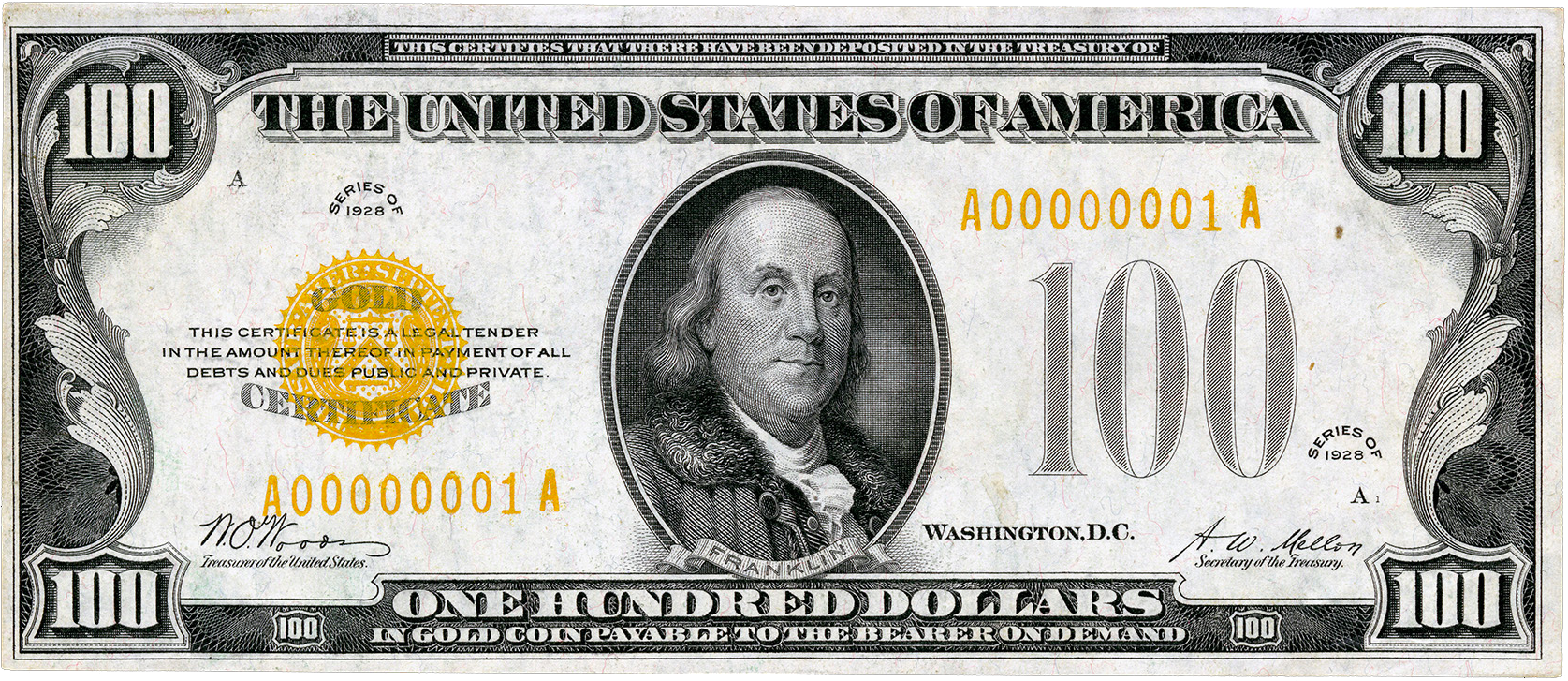

Representative Money

This is a form of currency that signifies a claim on a commodity. Think of paper notes, which are not inherently valuable but represent an equivalent value in commodities like gold or silver. It's a convenient way to facilitate trade without lugging around hefty amounts of precious metals.

Fiat Money

This is a type of money that isn't tethered to any physical commodity. Its value is rooted in the trust and confidence of the people, reinforced by a government declaration of its legality. Fiat money provides governments the flexibility to manage economic activity, albeit at the risk of potential value fluctuations.

Digital Commodity Money

In the era of digitalization, currencies like Bitcoin and Litecoin have emerged, underpinned by Proof-of-Work. Bitcoin, created in 2009, was devised as an alternative to traditional fiat currencies and has become the poster child for digital money. Source: Digital Assets - CFTC.gov

Money, from cowry shells to cryptocurrency, has continued to evolve, reflecting the changing needs and technologies of our societies. Today, it continues to remain an integral part of our socio-economic fabric, facilitating trade and measuring value.